Recovery of industrial robot market gathers pace

30 April 2021

Shutterstock image

The landscape for the industrial robot market is undergoing significant change. In a new article drawing on Interact Analysis’s recently released industrial robots report, Senior Research Director Jan Zhang gives an overview of the prospects for industrial robots by end user industry.

As the world emerges from the COVID-19 pandemic, the landscape for the industrial robot market is undergoing significant change. Automotive is a key sector for the industrial robotics industry due to its size and the high level of automation in the industry. In its industrial robot report, Interact Analysis highlights how the global virus shock, coupled with government climate change targets, has thrown the automotive sector into flux with, at least in the short term, low levels of vehicle production and sales.

This has had a major negative impact on the global industrial robot market, even though at the same time the research is also showing high investment in robotics in many other sectors, such as food and beverage, and chemical and pharmaceutical. We are looking at lean times for the robotics industry, as these non-traditional sectors utilise fewer robots on their production lines than automotive, but we sense optimism in the years to come. In this insight, we look at the current state of play for the industrial robotics industry in a range of key sectors and make some predictions for the industry in the short and longer term.

Automotive: An industry at the crossroads

All industries go through cycles, with periods of growth and times of contraction. What we are currently seeing in the automotive sector, however, is not cyclic change. We are seeing an industry both traumatised by the pandemic and poised for transformation. We have reported substantial decline in 2020 for automobile-related industries and we anticipate a gradual recovery of investment and production in the sector in some regions in 2021, but we do not expect a full recovery to happen for at least two or three years. The fate of industrial robotics is uniquely tied to the automotive sector. Take Germany, for instance, where the massive automotive industry made the country the largest market for industrial robots in 2019. The subsequent downturn in the traditional German automotive sector in 2020 has left the country’s industrial robot sector with a projected five-year CAGR of a mere 1.5%. The push for zero-emission vehicles will, however, bring transformative change in the automotive sector, and that will be both a major challenge and a landmark opportunity for the industrial robots sector as investment in the traditional automobile industry declines but investment in clean energy vehicle production increases. Robotics companies will need to be on the front foot where innovation is concerned, ready to respond to the demands from car makers and component and power-train manufacturers for new automation solutions on production lines.

Articulated robots have been the largest robot type used in the automotive industry, accounting for 80% of sales to the sector in 2019 and they are likely to remain in pole position at least until 2024, and most likely over the much longer term. Spot welding and arc welding robots are the two largest applications and most leading robot vendors have a strong stake in automotive. Though robots already have an important presence on vehicle assembly lines, there is still considerable potential for further growth here, particularly for human/robot shared assembly tasks including soft parts. We forecast considerable growth for the collaborative robot sector here, but articulated robots fulfilling welding tasks will continue to be well ahead of the field in terms of new orders.

We predict that electric vehicle production will bring growth for robotics, particularly for the articulated robot market, though we acknowledge that uncertainties about EV technology, coupled with the current depressed economic situation mean investment is slow at the moment. These difficult times will pass, however. Business confidence will return, and the technology is clearly here to stay.

Electronics: China by far the strongest market for robotic applications

The years 2017-2019 saw significant downturns in robotics shipments to the electronics sector, mainly owing to the decline in global smartphone sales, and the US-China trade war. Year-on-year growth dropped from 30% in 2017 to 13% in 2018 and then down to 5.6% in 2019. In our last report, we predicted a rapid rebound for 2020, based on our analysis of the market cycle for the electronics sector, but we did not anticipate the COVID-19 factor. Market demand is still there though, and we have concluded that the 2020 rebound will simply be pushed back into 2021 as the electronics sector reaches its cyclical peak. We expect robot shipments into this sector to also peak in 2021, with a growth of 10% compared to 2020. China will continue to be the strongest market for robotics applications in the electronics industry, with 67% of shipments destined for Chinese factories in 2024, as compared to 55.9% in 2019.

Unsurprisingly, most robots used in the electronics sector are small payload models with load capabilities of under 20kg, used for material handling. With the development of machine vision technology and integration, articulated robots are also increasingly being used for sorting, assembling, testing and inspection. In a rapidly evolving industry such as electronics, their innate flexibility means that collaborative robots have an important part to play in applications such as pick and place, inspection, and assembly. SCARA robots hold the ascendancy in the 3C industry, where they perform assembly tasks, including gluing and soldering, and sorting and packaging functions.

Semiconductor & FPD: 80% of robot shipments bound for APAC

The semiconductor and FPD industry is predominantly found in APAC which accounted for 80% of global production in 2020, coming mainly out of mainland China, Korea, and Taiwan. It is, then, no surprise that Japanese and Korean robotics companies are leading suppliers to this sector. 80% of global shipments of industrial robots for use in the sector are destined for APAC. Robotic applications in this industry are usually small payload models, for use in cleanroom settings for material handling. Many are customised, mainly cartesian or SCARA robots.

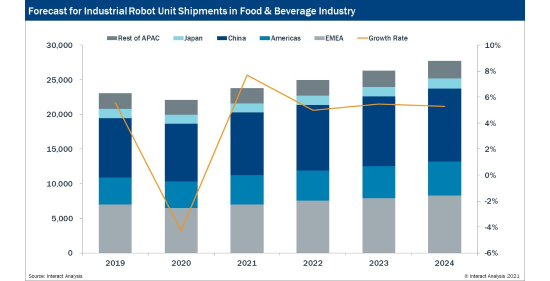

Food and beverage: The advent of the clean robot

Where automated solutions are concerned, food and beverage is definitely a growth sector. Growing populations in developing countries expecting a better standard of living have increased demand and expectations of the sector. Food preparation and packaging is also currently a major growth sector in European markets where there is a need for faster and more flexible packaging solutions, capable of responding quickly to consumer demand. This was particularly evident during the pandemic, with the explosion of e-commerce and online shopping. This is where robots take centre stage: articulated robots and collaborative robots are typically used in sorting, packaging and palletizing applications and delta robots are used for primary packaging. Hygiene and contamination issues in clean rooms where there is a high degree of manual handling of unpacked foods in the primary packaging process are driving the development of robots with a high protection class causing minimum contamination. The pandemic has also driven a broadening and deepening of applications of robotics in the food and beverage sector, such as in the realm of direct food preparation.

Chemical and pharma: COVID boost for robotics

During the COVID-19 pandemic, robot orders from the life science and medicine sectors increased significantly, notably in Western markets. High-cost customised industrial robots are traditionally used in the chemical and pharmaceuticals sector. However, we anticipate increased demand will see the average price decline. We forecast an increase in the proportion of SCARA and collaborative robot orders by this sector.

Expansion into new industries: The age of expectation

Industrial robotics is a burgeoning technology. Expectations are high as more and more sectors look to robotics as the solution of choice. Flexibility, versatility, intelligence connectivity and ease of use are factors which rank highly for end-users. In our ‘new’ or ‘other industries’ category, industrial and non-industrial sectors only recently turning their attention to robotics include ‘new energy’ related areas, such as Li-ion battery and photovoltaic cell producers and wind power equipment manufacturers. There has also been a burst of interest from the metals sector and in warehousing and logistics. Our research has found that investment in robotics in this ‘new’ or ‘other’ category of industries, where we tend to find the latest industrial robotics technologies, will outstrip the growth forecast for robotics in the more traditional industries where robots have been used. We forecast a CAGR of 6.9% for the period 2019 to 2024 for the robotics sector in these new industries.

To learn more about the industrial robots research, contact the Senior Research Director Jan Zhang directly on Jan.Zhang@InteractAnalysis.com

More information...

Contact Details and Archive...