Europe’s manufacturing growth lags behind US, new research says

06 February 2023

Image: Interact Analysis

According to Interact Analysis, the global manufacturing industry grew by 3.8 percent – but the Asia Pacific, Europe and the US have performed very differently.

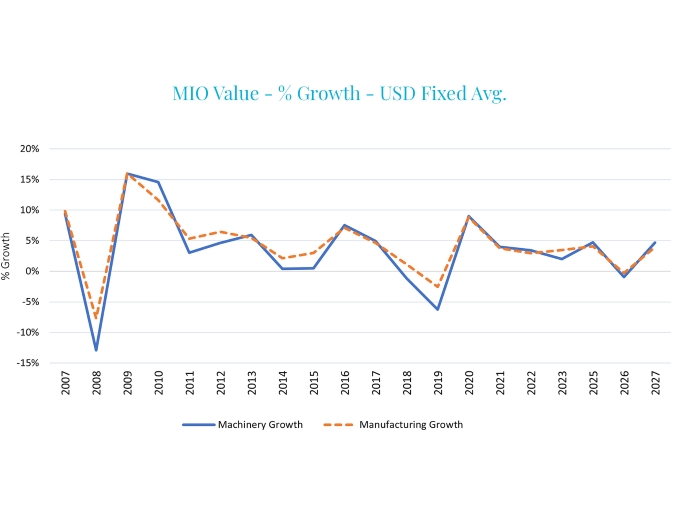

Growth in Europe has been slow throughout the year, while it has been strong in the US and steady in APAC. Machinery sectors have performed better than the manufacturing sector overall, and despite current challenges, the next global downturn for manufacturing is not expected until late 2025 or early 2026.

Regionally, the US manufacturing industry has performed strongly, and the Americas’ growth rate hit 6.9 percent in 2022, compared to 3.3 percent for Asia Pacific and 2.6 percent for Europe.

However, due to economic weaknesses across the regions, the Americas region is only forecasting growth of 3.1 percent in 2023. Despite ongoing supply chain issues and inflationary pressures, it is expected that overall global manufacturing industry output growth reached 3.8 percent in 2022.

The UK and Germany are suffering a particularly bad economic period due to Germany’s reliance on Russian energy and the UK’s current political turbulence. Germany also strongly relies on other countries for its exports that are experiencing similar difficulties.

Despite this, some sectors are still performing well in Germany, including forming machinery, where order intake grew by seven percent in 2022 due to strong export demand. Overall, German growth was slow, sitting at around 0.2 percent for 2022, while in the UK, the situation is similarly gloomy.

For the second year in three, manufacturing production has shrunk by around 0.5 percent, forcing the UK into a negative forecast for 2022. Many smaller regions had propped up Europe in terms of the region’s overall performance.

In contrast, the outlook for China remains positive, with 2023 to 2025 anticipated to be a period of growth and recovery for the country. As a result of further COVID-19 lockdowns, manufacturing output weakened, with growth contracting to 2.9 percent in 2022.

The predicted recessions across the US and Europe are expected to slow growth again in 2026, falling to similar rates to those seen in 2020 when the COVID-19 pandemic struck.

In China, the highest growth rates in 2022 were seen in the chemicals and pharmaceuticals industry, which grew by 4.9 percent. Conversely, wood products registered the lowest growth rate, declining by -1.7 percent.

Adrian Lloyd, CEO at Interact Analysis, adds, “The COVID-19 pandemic has had an undoubted impact on the world and many regions, especially China, are still suffering from the aftereffects. This, coupled with rising interest rates, inflation and supply chain constraints, has created the perfect storm.

“In Europe, the UK and Germany are perhaps suffering the most and this is expected to continue for the next few years. The situation in the US seems to be a little rosier, where growth in 2022 reached 8.7 percent for manufacturing, and 12 percent for machinery production overall.”