Components in industrial robot market worth more than $18bn by 2027

06 July 2023

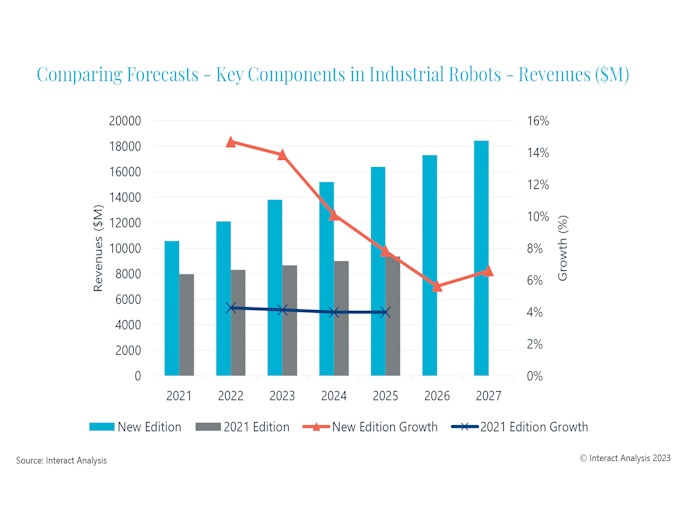

Interact Analysis significantly revised its forecasts up for the components in industrial robots market

Updated research by Interact Analysis shows that revenues for the key components in industrial robots exceeded $10.5 billion in 2021, which has led the company to revise their forecasts upwards for the next 5 years.

The key components considered in this research include motors, drives, precision gearboxes, robot controllers, teach pendants, sensors, end effectors and machine vision hardware. As a result of growing demand for industrial robots, the components in industrial robots market is predicted to be worth more than $18 billion by 2027, growing at a CAGR of 9.7 percent.

Interact Analysis significantly revised their forecasts up for the components in industrial robots market

The market for drivetrain components accounted for 42 percent of total component revenues in 2022, equating to $5.1 billion. This consists of motors, drives and precision gearboxes. Revenue from drivetrain components is set to grow at a CAGR of 7.7 percent from 2022 to 2027, slightly lower than the predicted growth rate of the total components market.

End effectors account for the largest share of this market, but the market for sensors and machine vision will grow the fastest between 2022 and 2027. This is in part due to increasing demand for robot safety and flexibility, which these components offer. End effectors currently represent the largest key component market as one robot can be equipped with multiple units.

Taking a regional perspective on the components in industrial robots market, Japan is currently the largest market, but China will catch up by 2027 in terms of revenue. Although the production volume of industrial robots in China exceeds that in Japan, the average selling price of components is much lower in China than in Japan, because of the intensive competition among local vendors. This factor therefore offers a boost for the Japanese industrial robot components market. EMEA is the third largest market followed by the Americas, but both regions show promising growth as a result of the growing production of collaborative robots in the region, as well as the increasing commitment of robot vendors to manufacture in North America.

Where robot types and payload ranges are concerned, for articulated robots, the components revenue is expected to increase most for robots with payload ranges of 80-300kg and 10-80kg, during the period of 2022-2027. For collaborative and SCARA robots, revenues of key components are expected to increase most for robots with payloads of 5-10kg, although the forecast of market growth rates is the highest for components used in robots with payloads of more than 20kg.

Samantha Mou, Research Analyst at Interact Analysis comments, “The demand for industrial robots is having a direct impact on the market for components in industrial robots. As well as this, many vendors are aiming for localized robot production in North America which is boosting components market in this region. We have significantly revised our forecasts up for the total components in industrial robots market and the market is expected to enjoy substantial growth out to 2027.

“In terms of vendor landscape, most of the companies that produce their own drives and motors for industrial robots are manufacturers of motion control technology, for example Fanuc, Yaskawa, Estun and Inovance. Many vendors that do not currently produce motion control components are working to bring component production in-house, such as Epson, Siasun and Efort. This suggests a captive market. While most robot vendors still choose to buy gearboxes from external suppliers, some companies are also working to bring this production in-house or are making investments to facilitate this.”

About the report

The 2nd edition of the market report provides insight and in-depth analysis into the automation components used in industrial robots. The report complements Interact Analysis's current understanding of the industrial and collaborative robot markets, providing robot vendors and automation suppliers with the deepest possible insight into the development of the automation components used in each robot type and payload range of major robot types.

More on Interact Analysis here.

Contact Details and Archive...